Unleash Wealth: Diversified Portfolios, Adaptive Investments

Unleashing investment value involves transforming undervalued assets into growth opportunities using…….

Unleashing investment value involves transforming undervalued assets into growth opportunities using strategic analysis, like a chocolatier's art with chocolate molds. Diversifying investments across stocks, bonds, and real estate creates unique risk-return profiles, balancing risk and reward. Long-term strategies focus on steady growth and compounding returns, akin to tending a garden. Adaptability is key, monitoring market trends and adjusting portfolios actively. Success measured via ROI, IRR, TVM for tangible assets, and abstract KPIs for intangibles like brand value or innovation.

Investment Value: Unlocking Financial Potential with Strategic Choices. In this comprehensive guide, we explore the art of maximizing returns through diverse strategies. Using a chocolate molds metaphor, we illustrate how a well-balanced portfolio can create delicious outcomes. We delve into risk management, long-term planning, and market adaptability, offering insights for investors to navigate complexities. Discover metrics for success and learn how to sow seeds for future financial harvests, ensuring your investments grow like a robust garden.

- Unlocking Potential: The Power of Investment Value

- Chocolate Molds: Metaphor for Diversified Portfolios

- Risk vs. Reward: Balancing Act in Investment Value

- Long-Term Strategies: Sowing Seeds for Future Harvest

- Market Trends: Staying Ahead with Adaptive Investments

- Measuring Success: Metrics for Evaluating Investment Value

Unlocking Potential: The Power of Investment Value

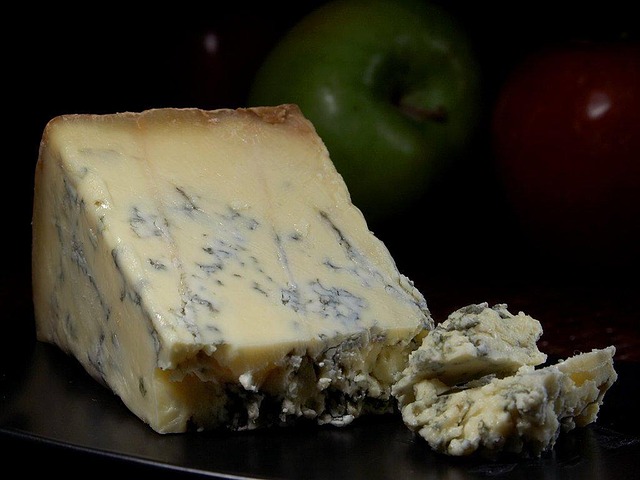

Unlocking potential is at the heart of investment value, much like a skilled artisan using intricate chocolate molds to create beautiful, unique shapes from raw cacao. It’s about transforming something ordinary into something extraordinary. In the context of investments, this means identifying undervalued assets or companies with growth potential that the market hasn’t yet recognized.

Just as a talented chocolatier can transform a simple ingredient into an art form, savvy investors seek to do the same with their portfolios. By carefully analyzing financial data, industry trends, and company fundamentals, they can uncover hidden gems—investments that have the power to grow significantly over time. This strategic approach allows investors to not only protect their capital but also generate substantial returns, ultimately unlocking the full potential of their investments.

Chocolate Molds: Metaphor for Diversified Portfolios

Imagine a baker preparing a batch of chocolates. They don’t simply pour liquid chocolate into one large mold, but instead use a variety of smaller molds to create different shapes and flavors. This act of employing diverse molds is a powerful metaphor for building a diversified portfolio in investments. Just as each mold casts a unique form, different investment vehicles offer distinct returns and risks, creating a balanced portfolio that minimizes potential losses while maximizing gains.

Just as chocolate varieties appeal to varied tastes, a diversified investment portfolio caters to different financial objectives and risk tolerances. By spreading investments across stocks, bonds, real estate, and other asset classes, investors can navigate market volatility more effectively. Just as well-crafted chocolates result from precise temperature control and careful timing, diversification requires thoughtful allocation and regular review to ensure that the portfolio aligns with individual financial goals and remains adaptable to changing market conditions.

Risk vs. Reward: Balancing Act in Investment Value

Investment value is a delicate balancing act, akin to crafting intricate designs using chocolate molds. On one side lies risk—the potential for losses and unpredictable market fluctuations. On the other, reward—the chance for substantial gains and growth. Successful investors dance on this tightrope, understanding that managing risk is as crucial as seeking rewards.

Diversification, like using various chocolate mold shapes, plays a pivotal role in this equation. By spreading investments across different asset classes, sectors, and regions, investors can mitigate the impact of any single risky endeavor. Just as combining different flavors and textures in chocolate creations enhances the overall experience, a well-diversified portfolio has a better chance of navigating market storms and delivering consistent returns over time.

Long-Term Strategies: Sowing Seeds for Future Harvest

Investing isn’t just about quick gains; it’s an art of nurturing your wealth over time, much like a gardener tending to their garden. Long-term strategies focus on building a robust financial foundation that bears fruit steadily. It’s akin to using chocolate molds to shape your future; you invest in various assets, allowing them to grow and compound over years. This approach ensures a steady stream of returns as your investments mature, similar to how chocolate hardens and becomes a delightful treat.

By adopting this mindset, investors can navigate market fluctuations with patience, understanding that the true value lies in the long-term potential. It’s about sowing seeds today for a harvest tomorrow, where each investment decision is a step towards financial security and prosperity.

Market Trends: Staying Ahead with Adaptive Investments

In today’s dynamic market landscape, staying ahead means embracing adaptability in investment strategies. Market trends are like intricate chocolate molds; they constantly evolve and shape financial opportunities. To navigate this ever-changing environment, investors must be agile, quickly adjusting their portfolios to capitalize on emerging patterns. By closely monitoring these trends, from technological advancements to global economic shifts, adaptive investments can ensure long-term success.

This proactive approach involves diversifying across various sectors and asset classes, allowing investors to mold their strategies according to market movements. It’s not just about following the latest buzz; it’s about understanding the underlying factors driving trends. For instance, recognizing the rise of sustainable investing or the impact of digital transformation can help investors make informed choices, ensuring their portfolios remain relevant and profitable in a constantly shifting investment arena.

Measuring Success: Metrics for Evaluating Investment Value

Measuring success is a critical aspect of evaluating investment value, akin to using chocolate molds to shape an investment’s potential. The metrics employed can vary widely depending on the nature of the investment and the goals of the investor. For long-term investments like real estate, metrics such as annual return on investment (ROI), internal rate of return (IRR), and time value of money (TVM) become essential tools. These help in gauging the financial health and profitability of the asset over time.

In contrast, for intangibles like brand value or innovation, metrics are more abstract. Key performance indicators (KPIs) such as customer satisfaction scores, market share growth, or the number of successful product launches can serve as chocolate molds for assessing these investments’ impact and potential. By examining both financial and non-financial indicators, investors gain a holistic view of investment value, ensuring they make informed decisions that align with their strategic objectives.

Investment value, as explored through diverse lenses like chocolate molds, risk-reward dynamics, and market trends, reveals a nuanced approach to building wealth. By balancing risk and reward, adopting long-term strategies, and utilizing adaptive investment methods, individuals can unlock their portfolio’s true potential. Embracing these principles allows investors to navigate the ever-changing financial landscape, ensuring their assets grow like the intricate designs cast by chocolate molds—both robust and beautiful.